For a small business owner, performing a cash flow analysis

regularly is essential for success. After all, running short of cash is one of

the most common causes of small business failure. The good news: Regular

analysis of your cash flow can help you avoid this pitfall and manage your

business more effectively.

What is a cash flow

analysis?

You perform a cash flow analysis using a cash flow statement. This

is a financial statement that records how money flows into and out of your

business during a specific pre-determined period of

time.

Why is a cash flow analysis

important?

A cash flow analysis gives you a well-rounded picture of your

business’s financial health. Regularly analyzing your business cash flow will

tell you whether you’ll be able to make payroll, pay your suppliers, buy the

materials to fulfill orders or carry out expansion

plans.

If your cash flow analysis shows you’re running short of cash, you

can plan ways to cut costs, obtain short-term financing, or take steps to

accelerate income. If your cash flow analysis shows you have extra cash on hand,

consider whether to invest it in new equipment or save for future slow

periods.

Keep in mind that having a lot of cash on hand doesn’t necessarily

mean your business is profitable—that’s determined by your profit margins.

Conversely, even a business with strong profit margins can get into financial

trouble if it doesn’t have the cash on hand to pay the bills. And a business

that has a lot of debt at one point in time can still be financially strong as

long as the owner knows projected cash flow can be relied on to cover the

debts.

How do I conduct a cash flow

analysis?

It’s a good idea to perform a cash flow analysis at least once a

month, but you can certainly do so more often. If you are in a highly volatile

industry or experiencing cash issues, you may want to do a cash flow analysis

weekly or even daily. Project your cash flow out for whatever time frame you

choose. Four to six weeks is a good starting

point.

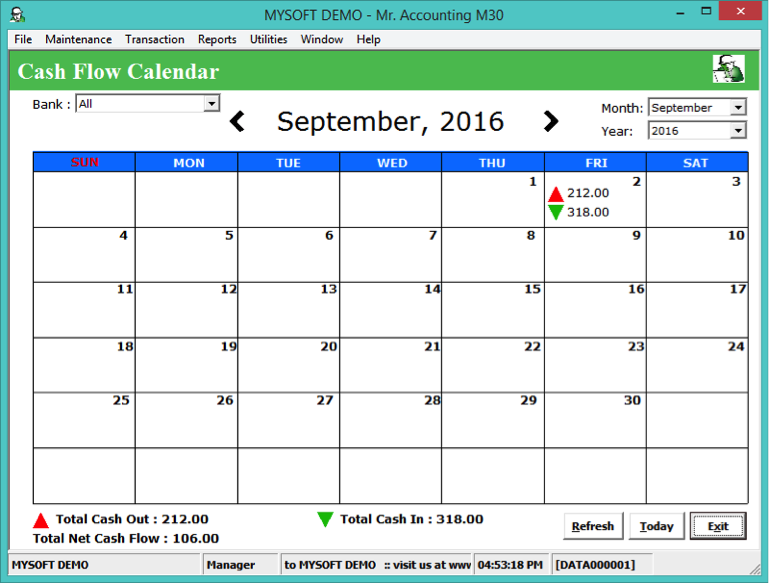

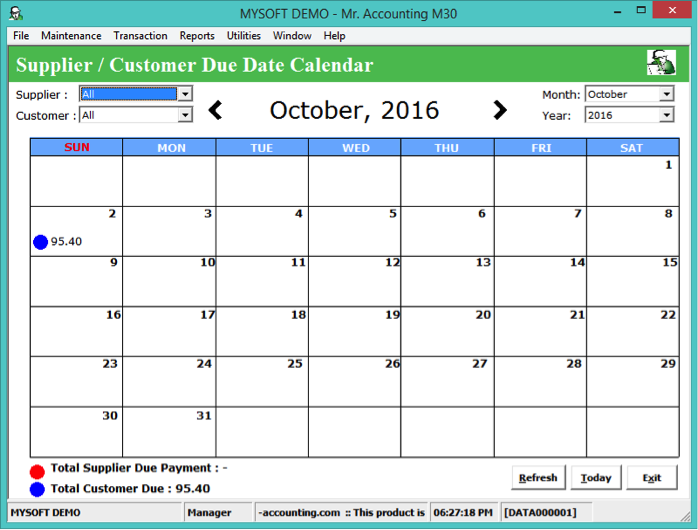

If you are using Mr. Accounting, our Cash Flow Calendar allows you

to view your cash in and out monthly. This intelligent application also allows

you to track your customer and supplier due in an easier and more effective way.

From here, you can forecast the monthly cash balance of your

company and see whether your company is short of cash or having too much cash in

hand. With this you can perform business planning in order to ensure that your

business can run smoothly.

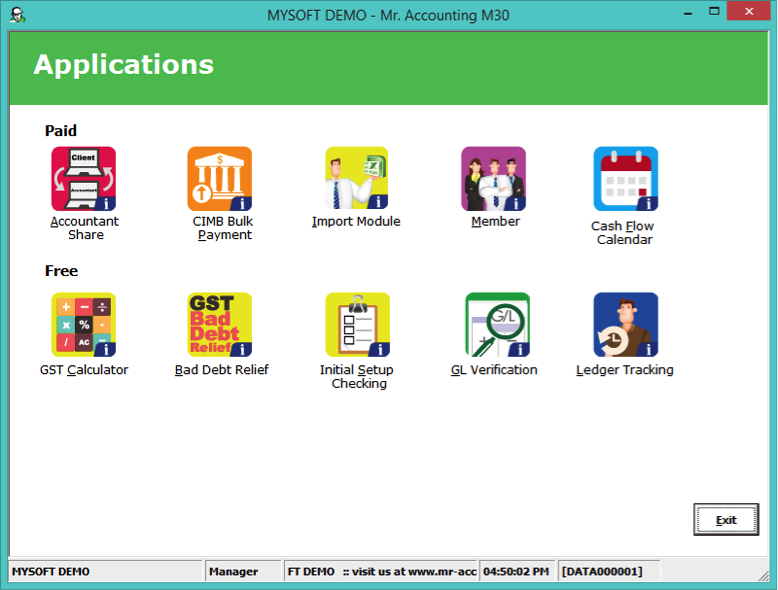

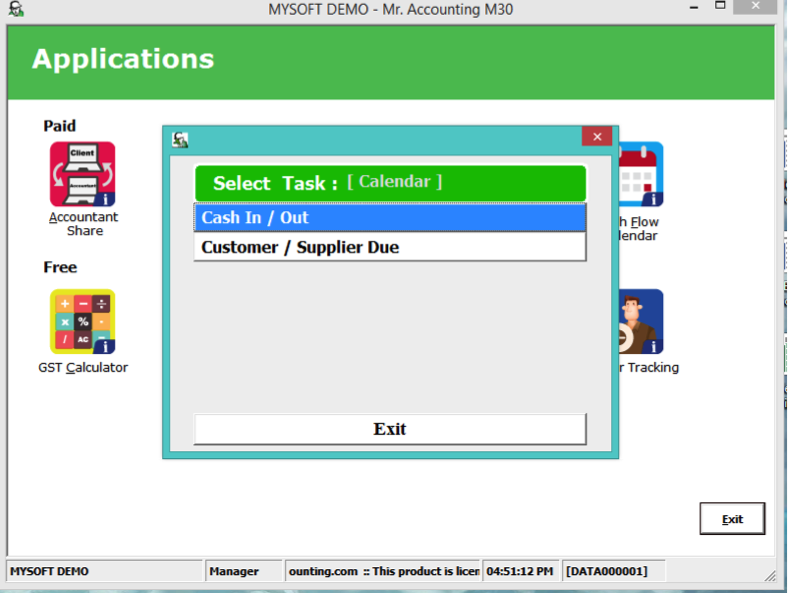

Cash Flow Calendar as one of the applications in

Mr. Accounting Version 10.

You can track your cash in/ out as well as your

customer/ supplier due here.

You can see your total cash in and out as well

as total net cash flow per month in this

calendar.

You can see your supplier and customer due per

month in this calendar.

Once I’ve conducted a cash flow analysis, what should I do with the

information?

The more frequently you conduct a cash flow analysis,

and the longer you do so, the more you’ll learn from it, as you’ll begin to see

patterns. For example, you might notice that your cash flow is positive most of

the time, but regularly becomes negative during the third week of every month.

Unfortunately, you also notice that most of your business’s bills are due the

fourth week of the month. This means you’re often caught short of cash, which is

causing late payments and hurting your business credit rating and reputation

with suppliers.

By examining your cash flow statement, you can figure

out possible ways to remedy the problem. To cover the shortfall, you can either

cut your costs or increase your income. Ideas for accomplishing these might

include:

n Adjust staffing during the month to decrease

payroll

n Buy less inventory if you’re adequately

stocked

n Paying vendors later (still staying within your due

dates, of course)

n Email a special offer to bring in more customers and

increase sales

n Reach out to late-paying customers to speed up

payments

n Raising prices

n Finding a source of short-term working capital to get you back in

the black

Creating a cash flow analysis might seem intimidating at first, but

once you’ve done it a few times, you’ll wonder how you ever ran your business

without it.

Credit: Rieva Lesonsky, Fundera