What is Initial Setup

When you first start a newly

installed software, there are some default settings that you need to setup in

order to configure the software according to your requirements. In Mr.

Accounting, these settings include: GST default setting, Tax setting, General

Ledger setting, Customer setting, Supplier setting etc. These settings will

affect every transaction you done in Mr.

Accounting.

Benefits of Using Initial Setup

Checking

This application allows you to check

errors in your initial setup. It can also show you the details of settings that

contain errors as well as guide you how and where to amend the

error.

How Initial Setup Checking

Works?

Section 1: Check master file default

setting in accounting system such as General Ledger, Customer Ledger, Supplier

Ledger, Product Master and GST Master

Setting.

Section 2: Check Customer and Supplier

master file information that related to accounting posting and GST

rulings.

Section 3: Check Tax Code setting to see

whether the tax code is included in GST-03 Return or

not.

Section 4: Check Delivery Order that has

been issued for more than 21 days but still without Tax Invoice at the end of

GST submission period.

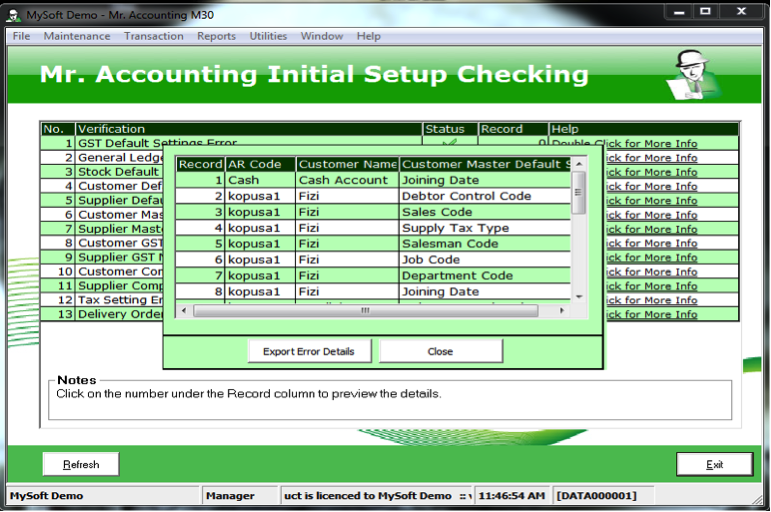

Double click on ‘Record’ to show the details of

settings that contain errors.

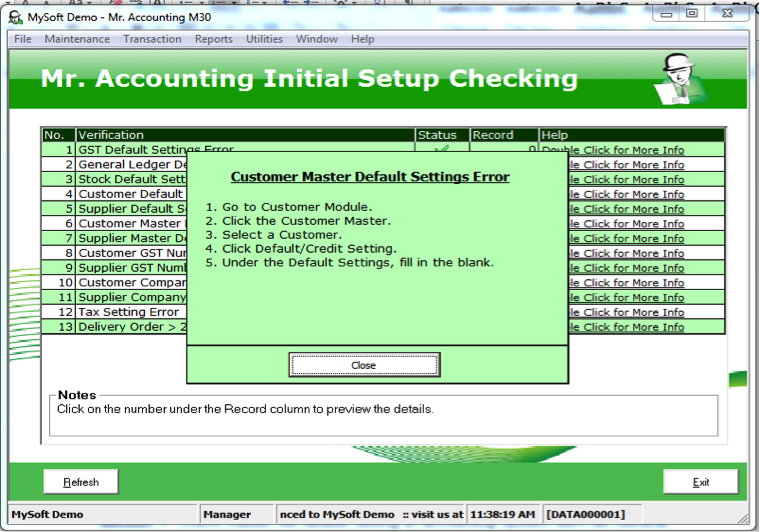

Double click on ‘Help’ to show the simple guide on how and

where to amend the setting error.